Total tax rate for medium sized businesses 2018 Statista Guide to taxes in Malaysia brackets-incentives - ASEAN UP Related. Rate TaxRM 0 - 2500.

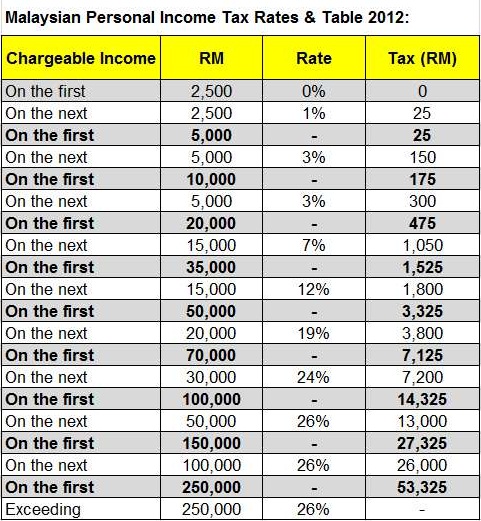

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800.

. 6 rows Corporate - Taxes on corporate income. Malaysia Corporate Tax Rate was 24 in 2022. Tax Rates for Company Company tax applies to all those companies that are.

Malaysia Non-Residents Income Tax Tables in 2019. Company Taxpayer Responsibilities. Tax Rate of Company.

Last reviewed - 13 June 2022. If the paid-up capital is RM 25 million or less for a resident. Income Tax Rates and Thresholds Annual Tax Rate.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at. The standard corporate income tax rate in Malaysia is 24. Tax Rates for Individual.

Not only has the corporate tax rate been decreased over the years the. On the First 2500. 0 0 or 15 10.

Company with paid up capital not more than RM25 million. On the First 5000 Next 5000. Tax Rate of Company.

Headline corporate capital gains tax rate Generally gains on capital assets are not subject to tax except for. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. Special classes of income.

On the First 10000 Next 10000. Malaysia Non-Residents Income Tax Tables in 2019. Resident company with a paid-up capital of RM 25.

Corporate tax rate 2019 malaysia - Japan Corporate. Interest paid by approved financial institutions. Income Tax Rates and Thresholds Annual Tax Rate.

The latest comprehensive information for - Malaysia Corporate Tax Rate - including latest news historical data table charts and more. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Company with paid up capital not more than RM25 million company tax rates is 17 on first RM600000.

Contract payment for services done in Malaysia. Other corporate tax rates include the following. The business tax Malaysia or company tax for both resident and non-resident companies in Malaysia is 24.

20182019 Malaysian Tax Booklet 22 Rates of tax 1. For both resident and. Companies that are about to establish their presence in Malaysia are allowed to apply for 0 to 5 tax rates based on the investments and commitments to job-creation.

Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching. Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019.

Capital gains tax CGT rates. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

Malaysia Sst Sales And Service Tax A Complete Guide

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Sme Corporation Malaysia Sme Corp Malaysia Quarterly Survey

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

T20 M40 And B40 Income Classifications In Malaysia

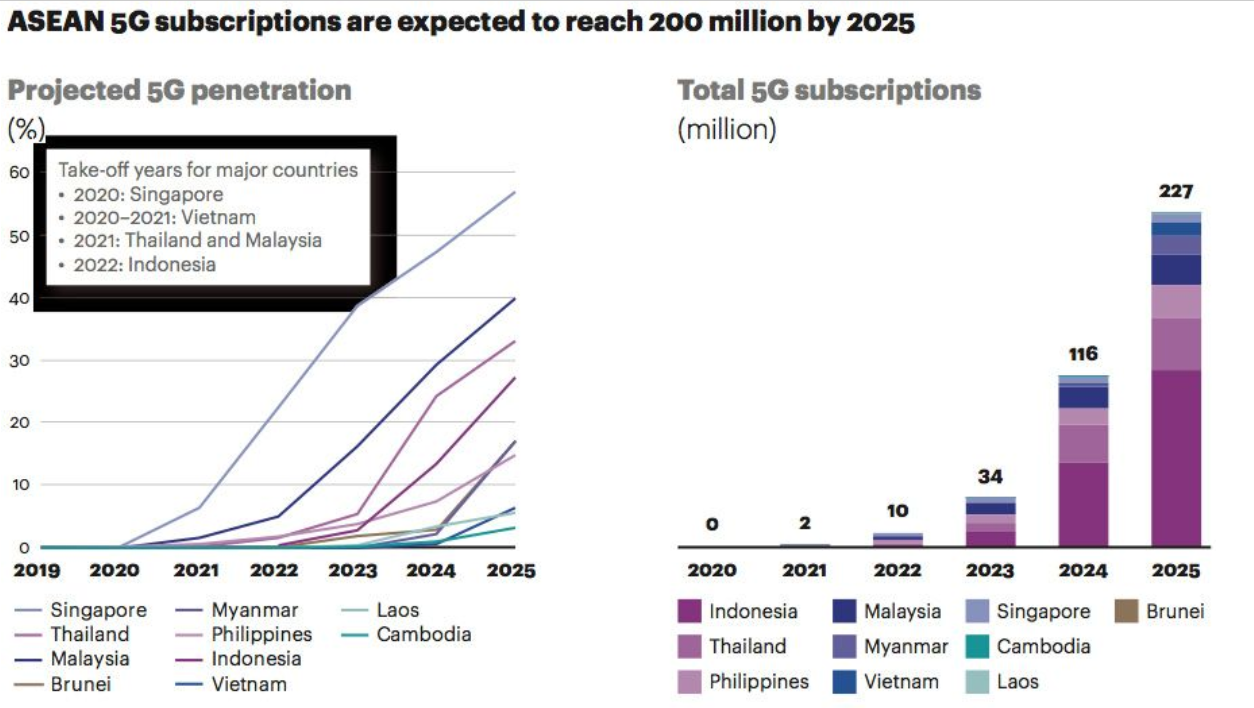

5g Technology Moving Industries By Leaps And Bounds Mida Malaysian Investment Development Authority

Sme Corporation Malaysia Profile Of Msmes In 2016 2021

Malaysia Share Of Economic Sectors In The Gross Domestic Product 2020 Statista

Malaysia Economic Performance First Quarter 2019home Statistics By Themes National Accounts Malaysia Economic Performance Malaysia Forced Labor Economy

Malaysia Corporate Income Tax Rate Tax In Malaysia

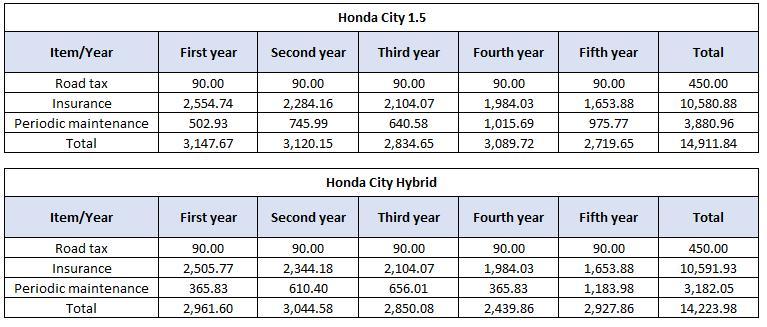

2020 Honda City Less Than Rm 3 900 To Service It Over 5 Years 100 000 Km Wapcar

With The New Year Approaching Quickly It Is Imperative To Get Your Things In Order So You Have Ample Time To M Investing Property Investor Investment Property

Sme Corporation Malaysia Profile Of Msmes In 2016 2021

Sme Corporation Malaysia Profile Of Msmes In 2016 2021

The State Of The Nation Epf 2021 Dividend Set To Top 2020 Absolute Payout To Hit New All Time High The Edge Markets